MERCHANT SERVICES

Payment Gateway Software Development

Millions of businesses of all sizes—from startups to large enterprises—use Rubicon Payments and APIs to accept payments, send payouts, and manage their businesses online.

Scale your business with Rubicon Payments.

Payment Gateway Software Development & Integration

Our expert software developers have extensive knowledge and experience in building, customizing, and integrating PCI DSS-compliant payment gateway systems designed for ISOs, MSPs, and PSPs.

EMV Development Services

Our highly skilled software engineers customize EMV-compliant software, integrations, migrations, and certification services, as well as program mobile, Bluetooth, and USB connectivity for EMV terminal mobility. We integrate your POS system using a powerful SDK and other industry-leading solutions for seamless EMV payment processing, as well as EMV certification services for Visa, MasterCard, American Express, Discover, and more.

Payment Integration Services

We integrate your preferred payment gateway system (PayPal, Stripe, Authorize.Net, etc.) with your third-party APIs to leverage your complete payment gateway infrastructure and enable payments directly on your web app, mobile app, or website.

MSP & ISO Payment Integration

We provide custom payment gateway integration for MSPs and ISOs so that merchants will have connected access to different payment methods and transaction information on one integrated platform. Our experts will integrate your Value Added Reseller (VAR) Sheet with a secure payment gateway system or third-party payment processing software to ensure reliable communication between your merchant account and payment gateway.

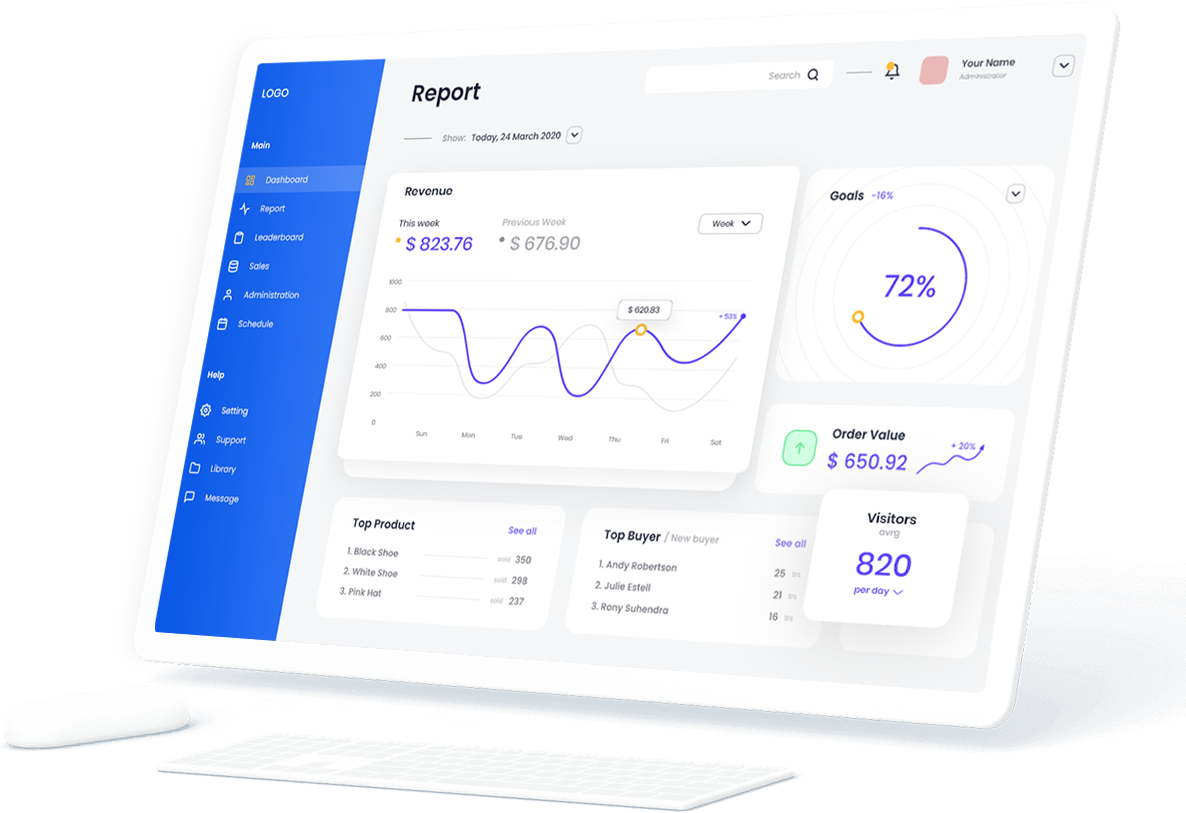

Features

End-to-end payments, data, and financial management in a single solution.

Payment Gateway Solutions

We utilize the same SDK as industry-leading brands so you can accept online payments from anywhere throughout the globe using our custom online payment gateway solution.

Broad OS Support

We provide broad OS support, making manual and automatic software updates, and integrating third-party systems for a seamless mobile payment experience for all devices.

Simple Transfer Methods

Adipiscing eli neque mi diam nim etus arcu porta viverra pretium auctor ut nam sed adipiscing eliId neque mi diam nim etus arcu porta viverra.

E-Commerce Payment API

Solutions

We engineer your custom e-commerce API solution or integrate with industry-leading payment APIs with your custom e-commerce payment gateway.

In-Store API Payment Integration

Our experienced and dedicated team of software developers integrate in-store payments, including EBT Food, EBT Cash, EMV Chip Cards, ACH, and so many other out-of-scope payments.

White Label Payment Gateway

Our custom white-label payment gateway systems are designed for all types of businesses and industry verticals, from retailers to e-commerce and everything in between.

Custom Payment Gateway Solutions

Our software developers customize your payment gateway systems to create a seamless,

highly-converting, and secure checkout experience, as well as offering turnkey

access to payment functionality at affordable costs.

News & updates

Our blog section is a hub for expert analysis, informative articles, and

thought-provoking discussions on the most pressing topics in the industry.